(The Center Square) – President Donald Trump says a trade deal with the United Kingdom announced on Thursday is the first of many more coming, and American markets are responding positively.

The deal is the first major pact reached since the president hit foreign nations with import taxes. At closing bells, the S&P 500 was up for the 11th time in 13 days; the Dow added 254 points; Nasdaq rose 1.1%; crude oil prices climbed; and Bitcoin rose to $101,000.

Treasury yields also went up.

The Trump administration agreed to ditch tariffs imposed on British steel and automobiles in exchange for buying Boeing jets and giving American farmers greater access to UK markets.

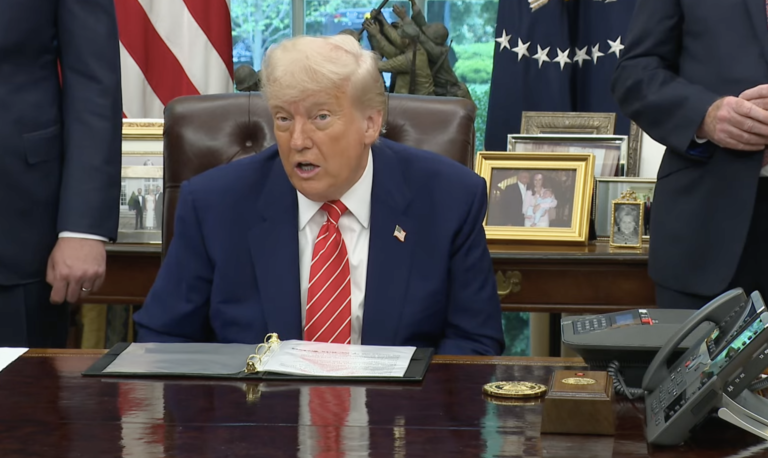

“The deal includes billions of dollars of increased market access for American exports, especially in agriculture, dramatically increasing access for American beef, ethanol, and virtually all of the products produced by our great farmers,” Trump said during the Oval Office announcement. “The UK will reduce or eliminate numerous nontariff barriers that unfairly discriminated against American products.”

Prime Minister Keir Starmer said the deal would save jobs.

“This is going to boost trade between and across our countries,” he said. “It’s going to not only protect jobs, but create jobs, opening market access.”

This trade deal will expand U.S. market access in the UK, creating a $5 billion opportunity for new exports for U.S. farmers, ranchers, and producers, according to the White House. That includes more than $700 million in ethanol exports and $250 million in other agricultural products, such as beef.

Trump posted on Truth Social that “many more” deals are in the works.

Trump announced a series of so-called reciprocal tariffs on foreign nations April 2, which he proclaimed was “Liberation Day” for U.S. trade. Seven days later, Trump paused those higher reciprocal rates for 90 days to give his trade team time to make deals. However, Trump kept in place a 10% baseline tariff, which applies to all nations, including the UK.

The president also slapped a 25% tariff on foreign autos and auto parts, but softened the hit for American automakers through rebates. Trump also hit China with a 145% tariff on imports from the world’s second-largest economy. China responded with a 125% duty on American imports, essentially freezing trade between the two superpowers. Trump put a 25% tariff on imported steel and aluminum.

Under the deal, the first 100,000 vehicles imported from UK manufacturers each year will be subject to the 10% rate. Any additional vehicles each year would be subject to the higher 25% rates. The U.S. will also negotiate an alternative arrangement with the UK on steel and aluminum.

Stocks rallied after news of the deal broke, with all major U.S. indexes up as of Thursday afternoon.

U.S. total trade with the UK was an estimated $148 billion in 2024, according to the White House. The UK average applied agricultural tariff is 9.2% while the U.S. average applied agricultural tariff (prior to April 2) was 5%. The White House further noted that “the UK maintains certain tariff and non-tariff barriers that restrict market access and create an unfair playing field for American workers and businesses.” It pointed to UK tariffs that can exceed 125% on meat, poultry, and dairy products and different food safety standards.

The UK is America’s ninth largest trading partner.

Trump’s “Liberation Day” tariffs face legal challenges at home, including a multi-state lawsuit and several challenges from other groups, including those representing small U.S. businesses. Democrats have filed legislation to exempt small businesses from tariffs. The U.S. Chamber of Commerce also asked Trump to grant automatic exclusions for any small business importer, establish a process for companies to apply for an exclusion if the company can show that tariffs pose a risk to employment for American workers, and providing exclusions for all products that cannot be produced in the United States or are not readily available.

Economists, businesses and many publicly traded companies have warned that tariffs could raise prices on a wide range of consumer products.

Trump has said he wants to use tariffs to restore manufacturing jobs lost to lower-wage countries in decades past, shift the tax burden away from U.S. families, and pay down the national debt.

A tariff is a tax on imported goods. The importer pays the tax and can either absorb the loss or pass the cost on to consumers through higher prices.