WASHINGTON, D.C. – U.S. Senator John Kennedy (R-La.) has joined a broad bipartisan coalition to reintroduce the American Innovation and Jobs Act, a bill designed to strengthen research and development (R&D) efforts by U.S. businesses and help them compete globally—especially against China.

The legislation, spearheaded by Senators Todd Young (R-Ind.) and Maggie Hassan (D-N.H.), would restore and make permanent the ability for companies to fully expense R&D costs, a benefit that expired in 2022. The bill also allows companies to retroactively claim deductions for the years during which the provision had lapsed.

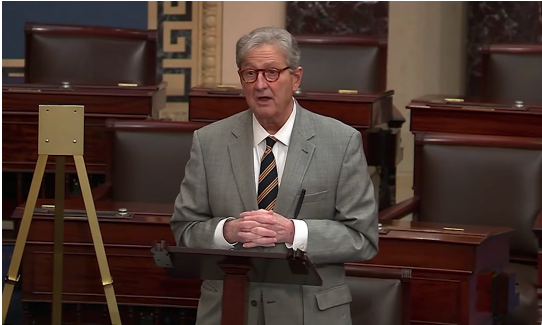

“Americans deserve a tax code that looks like it was designed on purpose, and that includes extending tax policies that encourage innovation,” said Senator Kennedy. “I’m proud to help introduce the American Innovation and Jobs Act to help our small businesses and startups compete against China.”

The bill is intended to incentivize job-creating innovation, especially among startups, by reducing the tax burden associated with R&D investments. Lawmakers say this support is essential to maintaining U.S. leadership in science and technology.

“Congress must pass this legislation to drive our innovation future, strengthen international competitiveness, and protect our national security,” said Senator Young.

“This bill will cut taxes for small businesses that invest in innovation,” added Senator Hassan. “It also helps the United States continue to outcompete adversaries like China.”

The legislation has drawn broad bipartisan support, with more than 30 cosponsors including Sens. James Lankford (R-Okla.), Jeanne Shaheen (D-N.H.), Steve Daines (R-Mont.), Mark Warner (D-Va.), Patty Murray (D-Wash.), Thom Tillis (R-N.C.), and many others from across the political spectrum.