WASHINGTON, D.C. – The U.S. House of Representatives has passed a joint resolution of disapproval introduced by U.S. Senator John Kennedy (R-La.) to block a Biden-era bank merger rule implemented by the Office of the Comptroller of the Currency (OCC). The resolution, passed under Congressional Review Act procedures, now heads to President Donald Trump’s desk for final approval.

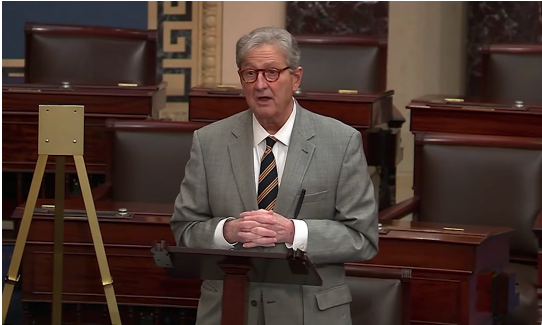

“When the Biden administration decided to tinker with bank merger rules for no good reason, they threw a gut punch to small community banks just trying to offer their customers a good service,” said Kennedy. “I’m grateful to the U.S. House of Representatives for doing the right thing, and I look forward to President Trump signing my resolution to undo this cumbersome regulation.”

The OCC’s rule, which went into effect January 1, 2025, changed the traditional review process by shifting the burden of proof to individual banks applying for mergers—making it more difficult, particularly for community and mid-sized banks, to complete mergers efficiently. Prior to the rule, if the OCC did not take action within 15 days of receiving a merger application, the merger was generally assumed to pass.

Rep. Andy Barr (R-Ky.), who chairs the House Financial Institutions Subcommittee, introduced the companion resolution in the House.

“Bank mergers create competition and efficiency in the banking system,” said Barr. “By eliminating this rule, we remove unnecessary guardrails that make smaller and medium-sized banks less competitive. This is another win for President Trump, who is making our economy stronger by cutting government red tape and unleashing the free market.”

The Senate passed the resolution on May 8, with support from co-sponsors Sens. Bill Hagerty (R-Tenn.), Thom Tillis (R-N.C.), Tim Scott (R-S.C.), Steve Daines (R-Mont.), and Bernie Moreno (R-Ohio).

The move has drawn praise from industry leaders, including the American Bankers Association (ABA).

“This action…will provide regulators with the opportunity to reenvision the framework governing bank mergers so that it more effectively promotes competition while allowing banks to better serve their customers,” said Rob Nichols, ABA President and CEO. “We look forward to President Trump signing this important resolution into law.”

If signed, the resolution will nullify the current OCC rule and restore the prior regulatory framework, which proponents argue will benefit community banks and consumers alike.