Baton Rouge, LA – The Committee of 100 for Economic Development (C100) has endorsed Governor Jeff Landry’s proposed comprehensive tax reform plan, praising its potential to drive economic growth and job creation across Louisiana. However, the endorsement comes with eight specific recommendations aimed at refining the plan to maximize its effectiveness and ensure financial stability.

C100 emphasized that the tax reform must be revenue neutral, ensuring that critical funding for education and healthcare is not compromised.

Supporting the Broad Framework

“We support the overarching concepts of this tax reform package and want to stress the importance of it all working together,” said Julie Stokes, Chair of C100’s Tax Reform Committee. “This is about creating a competitive revenue structure while ensuring stable funding for education, infrastructure, and economic development.”

Adam Knapp, CEO of C100, echoed this sentiment. “Louisiana needs a new strategy for its economy, and we believe these changes, taken as a comprehensive package, can drive significant opportunities for the state. While we have a few suggested improvements, we urge legislators to move this plan forward.”

Eight Key Recommendations from C100

- Economic Development Program Costs

Include anticipated costs for replacement economic development programs in the 2025-2026 budget if current programs are eliminated by tax reform. - Historic Rehabilitation Tax Credit

Retain this tax credit but consider implementing a lower cap. - Inventory Tax Credit

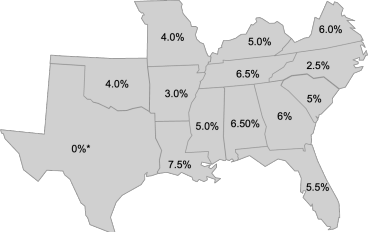

Maintain the inventory tax credit for parishes that do not accept the state’s “buy-out” of local inventory taxes until the tax is phased out entirely. - Centralized Sales Tax Collections

Push for centralized sales tax collections during the 2025 fiscal session. - Education and Research Funding

Replace funding for early childhood education and higher education research endowments in the 2025-2026 budget with a recurring dedication of equal value. - Comprehensive Package Linkage

Ensure all tax reform bills are linked to pass or fail as a complete package. - Adjusted Effective Dates

Delay the corporate and personal income tax reforms to January 1, 2026, and push back the sales tax reform effective date to July 1, 2025, aligning with the state’s fiscal year. - Sales Tax on Services

Exclude business-to-business transactions and avoid taxing disaster-related insurance proceeds or homeowner reconstruction funded by federal recovery grants.

A Collaborative Effort

The Committee highlighted that many aspects of the plan align with recommendations from their 2015 Tax Foundation study and last year’s RESET Louisiana platform. The group believes these reforms could position Louisiana as a leader in economic development if the plan is carefully implemented.

“This is an exciting opportunity for our state to adopt a modern tax system that supports long-term growth and prosperity,” said Knapp.

For more information about the Committee of 100 and its efforts, visit C100 Louisiana.