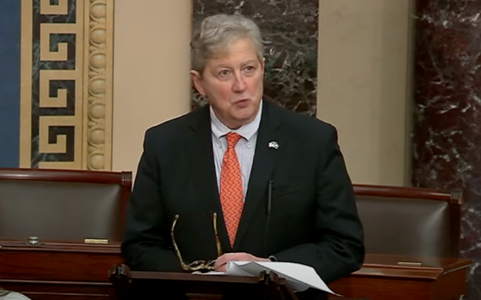

MADISONVILLE, La. – Sen. John Kennedy (R-La.), a member of the Senate Banking Committee, led senators in urging the Biden administration’s Consumer Financial Protection Bureau (CFPB) to pause the effective date of the Dodd Frank Section 1071 small business data collection rule. The rule would require banks to collect sensitive personal data on small business owners when they seek a loan.

Sens. Cynthia Lummis (R-Wyo.), Thom Tillis (R-N.C.), Steve Daines (R-Mont.), Bill Hagerty (R-Tenn.), J.D. Vance (R-Ohio), Mike Crapo (R-Idaho) and Kevin Cramer (R-N.D.) also signed the letter.

“At your agency’s request, a recent ruling in the U.S. District Court has created a situation where only some lenders, including large systemically important lenders, will receive a temporary reprieve from working towards implementation of the CFPB’s Section 1071 small business data collection rule (‘the 1071 rule’), while others, including many community banks and all credit unions, must seek further relief from the judicial system,” the senators wrote.

“As you are aware, we harbor deep concerns about the potential adverse impacts of the Consumer Financial Protection Bureau’s (CFPB) rule to implement Dodd-Frank Section 1071. Furthermore, we believe that the CFPB’s funding structure is in violation of the Appropriations Clause of the U.S. Constitution. In October 2022, the U.S. Court of Appeals for the Fifth Circuit concurred with this viewpoint, and the Supreme Court will be reviewing this matter in October,” they continued.

“In light of these recent developments, we respectfully urge the CFPB to exercise its existing legal authority by issuing a nationwide stay of the effective date of its Section 1071 rule for all credit unions and FDIC-insured banks, including community banks. This action would provide a crucial measure of certainty to small businesses and community banks, which are the cornerstone of the American economy, while we await a final determination of the validity of the Section 1071 rule by the Courts,” the lawmakers concluded.

In June, Kennedy questioned CFPB Director Rohit Chopra about the bureau’s plan to collect information including race, sexual preference and gender from businesses in order to borrow money from a bank.

Background:

- Kennedy introduced a Congressional Review Act resolution of disapproval of the CFPB rule to implement Dodd Frank Section 1071, which amends the Equal Credit Opportunity Act.

- Kennedy introduced the Transparency in CFPB Cost-Benefit Analysis Act to ensure that the CFPB does not establish regulations that would foist unreasonable costs or harms onto taxpayers, financial entities or consumers.

- Kennedy introduced the Small LENDER Act to protect Louisiana’s small businesses’ access to capital.

The full letter is available here.