By Molly Ryan and Claire Sullivan, LSU Manship School News Service

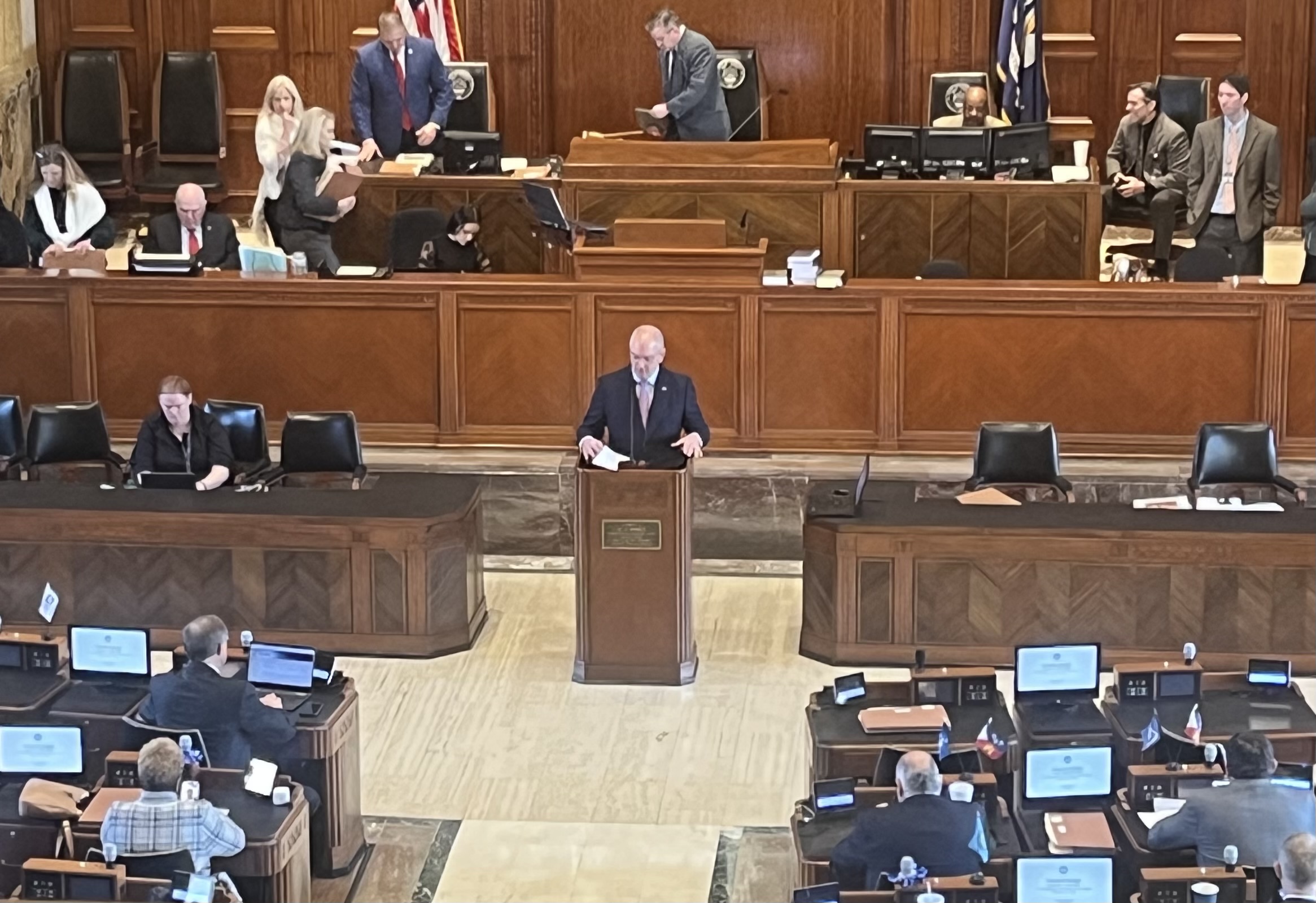

BATON ROUGE – Gov. John Bel Edwards proposed a budget Friday that includes a $2,000 pay raise for K-12 teachers that could climb to $3,000 if more money becomes available.

He also called for a $1,000 pay raise for support workers at schools.

Those basic raises would cost the state about $200 million each year. Teachers could receive the additional $1,000 raise, bringing the total increase to $3,000, if the state’s Revenue Estimating Conference increases its revenue projections again in May.

Commissioner of Administration Jay Dardenne said that would finally push teacher salaries in Louisiana to the Southern regional average and cost an additional $74 million annually.

In unveiling his final budget proposal, Edwards touted his sixth year in a budget surplus after inheriting a $2 billion deficit in his first term. Edwards’ second term ends in January.

“We’ve had the best budgets for education in the history of our state, from early childhood through K-12 and certainly including higher education,” Edwards said.

Edwards’ proposed budget also includes $57.1 million for the early childhood program with the Department of Education, more money for need-based Go Grants to cover college tuition costs and a 2% pay raise for university faculty.

“This is a homerun for education at every level,” Dardenne said.

Thanks to federal aid and higher-than-expected tax collections, the state finds itself with a budget surplus of $726.5 million from the previous fiscal year and $928 million in excess funds that must be spent before June 30.

Though the excess money is recognized as recurring funds, Edwards wants to allocate most of it to one-time expenses out of caution as the temporary 0.45% increase in sales tax is expected to roll off at the end of 2025 and could leave the state facing a revenue shortfall.

The one-time expenses include $340 million for transportation projects and the $45 million that the Legislature allocated earlier this month to a plan to lure home insurance companies back to the state.

Dardenne told reporters that $100 million would be placed in a higher education initiative fund to support programs like training nurses and $20.5 million would be used to help close the Road Home program, which assisted citizens after hurricanes Katrina and Rita.

Plus, $84 million would be allocated for acquisitions and major repairs to state buildings, primarily spent on corrections. The Department of Child and Family Services would also benefit in the form of cars and other equipment. DCFS has struggled to hire and retain employees and seen many failed cases in recent years.

Part of the surplus would be used to push the state’s rainy-day fund to its highest point ever of $903 million.

Under Edwards’ proposal, the budget for the state’s general fund would be $11.4 billion while the total budget, including all federal aid, would be $45.7 billion.

Increased revenue from federal aid after Hurricane Katrina led the Legislature and previous governors to make tax cuts that ended up pushing the state into the deficit Edwards inherited when those federal dollars rolled off.

A temporary law passed in 2016 increased sales tax by a penny. When that was set to expire in 2018, the Legislature faced a fiscal cliff, and had to call three special sessions to pass the temporary 0.45 cent of sales tax that is due to expire at the end of fiscal 2025.

The Legislature will review Edwards’ latest proposal in a session starting April 10 and is free to make changes. Dardenne told reporters that he expects little resistance to the spending from Republican lawmakers because it is an election year.

However, Rep. Blake Miguez, R-New Iberia, asked Edwards if some of the expenditures could leave the next governor facing another hole in his or her second year in office once the .45 cents of sales tax expires at the end of fiscal 2025.

Miguez expressed concern that the state’s current fiscal strength may stem too much from federal aid that could shrink and an extra boost from construction activity after the recent hurricanes.

Edwards said that the expiration of the .45 percent of sales tax could reduce state revenue by $800 million. But, he said, the state budget seems to be on a sound path, and if anything changes, the next governor would have time to decide how to handle it.

Dardenne told reporters that if there is no recession, gains in tax revenue should offset the revenue that the state loses when the extra sales tax expires.

Referring to the continuing growth in the economy so far, and the boost it is giving to state revenue, Dardenne said, “Nobody can say it’s not real.”

Edwards also struck a bipartisan tone, thanking lawmakers for all they have done to place the state on a better financial footing.

“It is remarkable how far we’ve come together since the early years after I took office,” Edwards said.