By David Jacobs | The Center Square

The Louisiana House’s tax-writing committee has approved a Senate bill that would remove a major tax break from the state constitution and lower the top income tax rate.

Senate Bill 159 is a key piece of a complicated effort to simplify Louisiana’s complex tax system, which critics say complicates state budgeting and drives away people and businesses, while trying to collect about the same amount of money.

Louisiana currently lets taxpayers deduct the full amount of their federal income taxes when tallying their state taxes. SB 159 would strip that provision from the state constitution, though lawmakers still would have the option to keep it in statute.

The state constitution also lays out tax rates of 2% on the first $12,500 of net income, 4% on the next $37,500 and 6% above $50,000 for individual taxpayers. Those brackets would be replaced with a maximum 4.75% rate, though rates still could be established below that level.

As with any constitutional amendment, the change would require support from at least two-thirds of each legislative chamber and a majority of voters statewide.

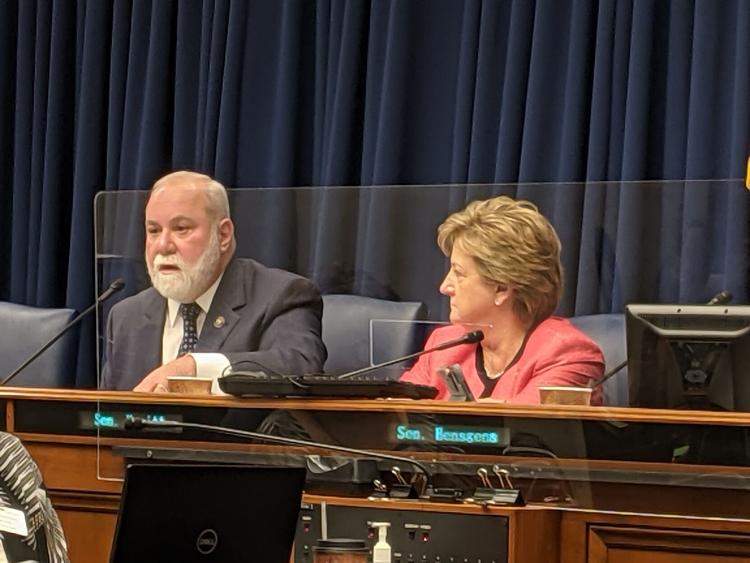

Policy groups and lawmakers across the political spectrum who have spoken up about the issue generally agree the federal income tax deduction is bad policy. Under the current situation, when federal taxes go up, state taxes go down, and vice versa; getting rid of the deduction allows state government to get off the “roller-coaster” and take control of its own tax policy, said Sen. Bret Allain, the Franklin Republican and Senate Revenue and Fiscal Affairs chair who authored the bill.

While the federal tax lowers the amount people have to pay, the official top rate, which is what most people see, remains relatively high, which makes Louisiana look like a less attractive place to live and start a business, Allain said.

“Businesses and individuals pay attention to these rankings,” he said, referring to the various think tanks that give Louisiana poor grades for its tax system.

But killing a popular tax break without giving taxpayers something in return likely wouldn’t fly with lawmakers or voters. The committee amended Allain’s bill at his request to lower the top tax rate from 5% to 4.75%, reasoning that the slightly lower rate would make the tradeoff more palatable.

The Legislative Fiscal Office reviewed the bill before the committee amended it and estimated lowering the top rate to 5% would cost the state about $222 million next year. Making the change while still collecting the same amount of revenue likely would involve repealing not only the federal income tax deduction but other tax breaks as well.

Jan Moller of the Louisiana Budget Project was the only witness to speak in opposition to the bill, and he agreed the federal deduction should go. He suggested, however, increasing spending in certain vital areas such as education (teacher pay in Louisiana lags well below the regional average) or reducing sales tax rates would be a better use of the revenue. Combined state and local sales taxes in Louisiana are second-highest in the nation, just slightly behind Tennessee, according to the Washington-based Tax Foundation.

The House Ways and Means Committee advanced SB 159 without objection Monday.