Tips on structuring your tax donations so they help local nonprofits as well as the community at-large

A local tax professional and nonprofit board member is letting business owners know that due to the new tax law, they need to adapt their donation strategies for area nonprofits.

Hardy Foreman, CPA and partner for Carr Riggs and Ingram and immediate past chair for Junior Achievement, warned that if business leaders don’t structure their deductions properly, they are in danger of losing that tax credit.

“If they can be strategic, they can get that tax benefit as well as benefitting their favorite nonprofit,” said Foreman. “Our clients all have their favorite nonprofits and still want to donate, but see the benefit of those donations.”

This is accomplished with the strategy of bundling. Foreman explained that by donating before nonprofits’ fiscal year ends on June 30 and then again before the end of the year, thus providing two investments in one calendar year for the donor, but donations across two years for the nonprofits. But then he advised that taking the standard deduction the following year.

“You get to itemize your donations that year, which taken in conjunction with other tax deductions will get you over the standard deduction amount of $24,000,” Foreman explained. “The worst thing that could happen is that you have your itemized deductions add up to $22,000. It’s like the game ends on the one-yard line. Be strategic and score the touchdown this year and next year kick the field goal. We’re playing to win.”

Foreman noted that retiree clients can also benefit from investing in nonprofits like Junior Achievement. He said at age 70.5, retirees are required to take disbursements for IRAs. If they designate a nonprofit such as JA as a beneficiary, that money goes directly to the nonprofit, meaning the retiree doesn’t have to pick up those disbursements as income and pay income tax on it.

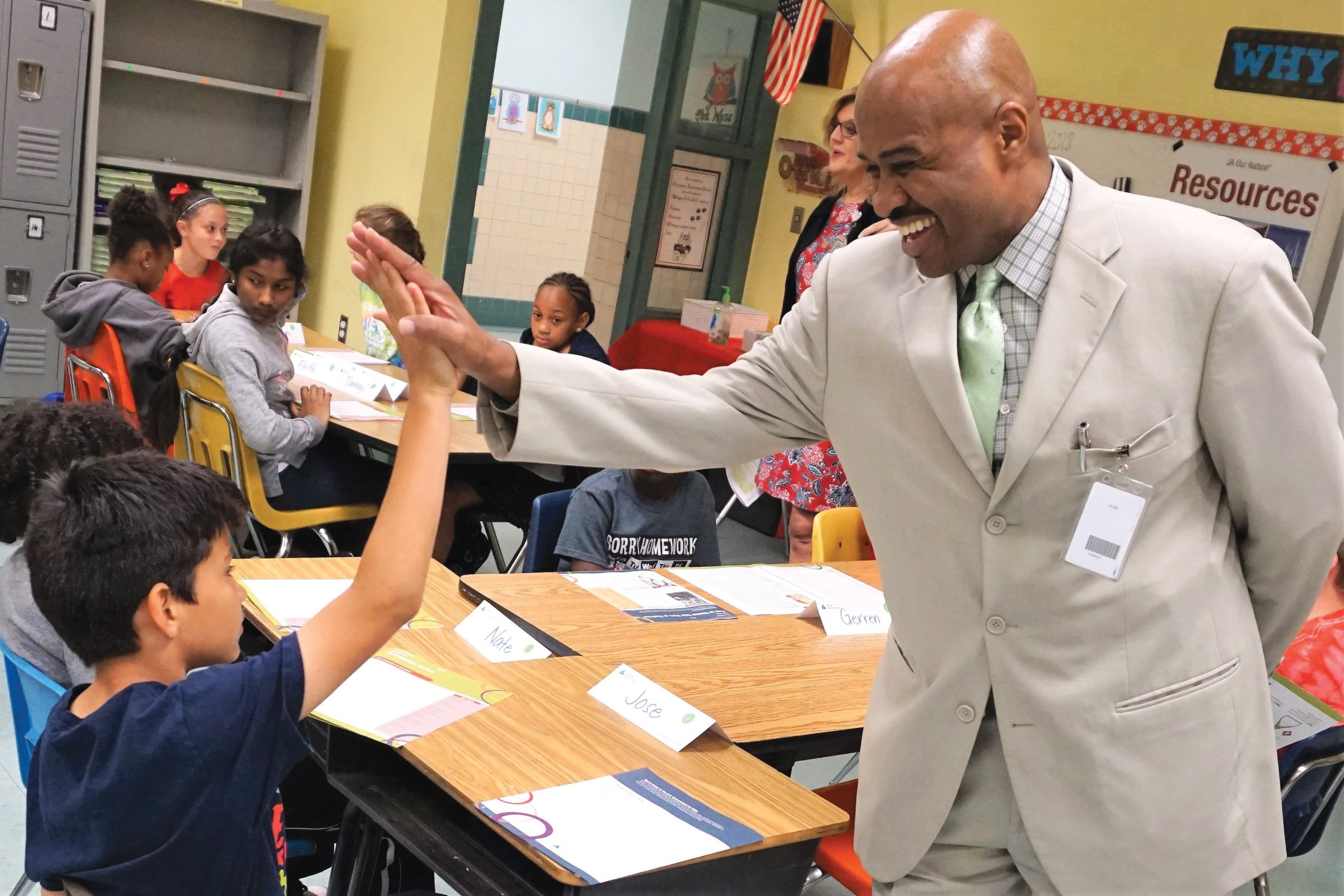

Nita Cook, president and executive director of Junior Achievement, said the return on investment made to JA is that it partners with Bossier and Caddo Parish school boards to provide crucial lessons in financial literacy, work readiness, and entrepreneurship to school children from elementary to high school.

“It all begins and ends with education. You want to reduce poverty and crime, it starts in the schools. And it starts at the elementary level. Biggest cause of crime is poverty and you can solve both with education. Sorely lacking is financial literacy, what do parents fight over that causes single-parent homes? Financial literacy,” Cook said.

Their volunteer-led program means mentors with real world experience can answer questions and share experiences with real situations.

“We help students connect the dots between education and future success and that increases understanding and the importance of staying in school,” Cook said.

The Community Foundation recently reported an increase of cohort graduation by 13 percent since 2010.

JA has seen an increase of 2,700 to 9,300 students in that time.

“While I don’t assign JA credit for that growth, I feel like the programs we’ve provided are teaching students to take responsibility and ownership of their education,” Cook noted.

She also noted that lessons in their three pillars is something that is valuable to everyone. And that by embracing it and facing that head-on, it can be transformative to the community of Shreveport-Bossier.

“If we don’t take problems in our community as a collective, then we’re never going to get rid of the problem. If everyone would take a bite of the elephant, then we could move mountains,” Cook said.