By Joby Richard, LSU Manship School News Service

BATON ROUGE – The fiscal cliff facing the Legislature is a little less steep than originally projected thanks to a new estimate that Louisiana will receive a $346 million windfall in tax collections as a result of changes in federal tax law.

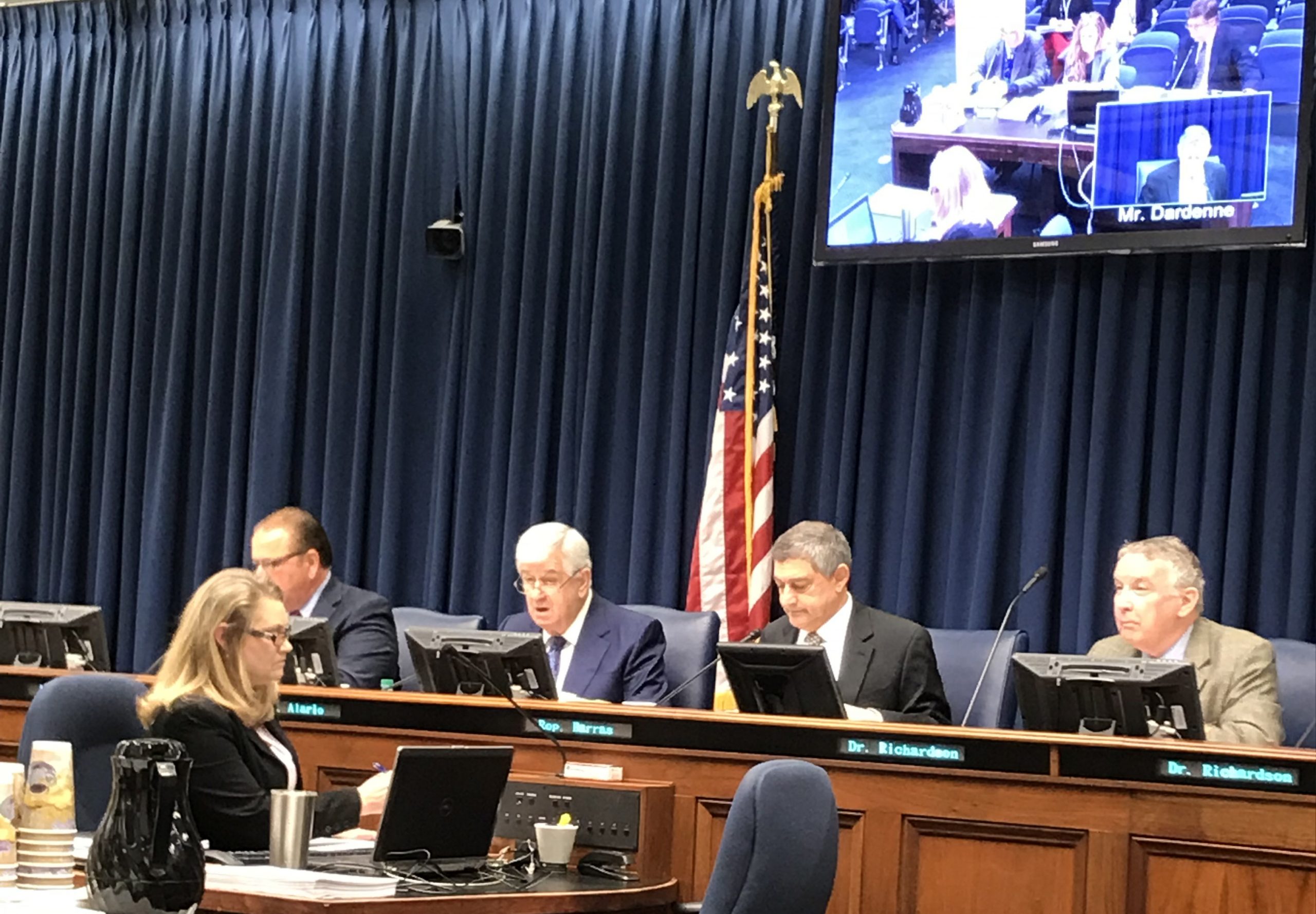

The Revenue Estimating Conference on Thursday adopted that estimate along with projections by the Division of Administration that the state could face a $648 million budget gap unless the Legislature votes to cut services or raise more revenue.

Gov. John Bel Edwards called a special legislative session in February to address the budget shortfall, which was then expected to total nearly $1 billion in the fiscal year starting July 1. But the session collapsed in early March after most House Republicans refused to vote for any tax measures.

Edwards is expected to call a second special session later this spring to deal with the remaining $648 million gap, Senate President John Alario, R-Westwego, has said he supports that plan.

House Speaker Taylor Barras, however, told reporters Thursday that that he feels the remaining gap could be resolved through budget cuts. He said the Legislature may not need another special session to consider taxes to replace a penny of state sales tax that expires on July 1.

The Revenue Estimating Conference met Thursday as part of it mandate to make quarterly projections of the state’s annual revenue.

Prior to the meeting, state officials had unofficially estimated that the changes in federal tax law would allow Louisiana to collect an extra $302 million next year.

Louisiana residents can deduct all of the federal taxes they pay on their state tax returns. So the recent federal tax cuts will lower the value of those deductions and increase the state tax bills for wealthier residents.

The four-person conference is composed of the House speaker, the Senate president, the commissioner of administration and a Louisiana State University economist.

Manfredo Dix, the Division of Administration economist, explained that the impact of the federal changes on corporate income tax collections are more difficult to project.

Projections are difficult because some of the companies operate nationally and internationally, and the state lacks any access to corporate tax planning.

Dix said that their operations in Louisiana are often small enough to be more of an “afterthought for these corporations.”

Personal income tax collections are more stable to project. The Division of Administration and the Legislative Fiscal Office both agree that for fiscal 2019, the state will generate about $340 million from personal income tax collections.

Commissioner of Administration Jay Dardenne said that state income taxes are not due until May 15. Thus, there will be no opportunity for the Revenue Estimating Conference to meet again before the fiscal year ends on June 30, when the state is constitutionally required to balance the budget.

Dardenne explained that the fiscal uncertainty may cause state income tax collections to decrease. He said private hospitals have already issued layoff notices.

For example, Lafayette General announced that it may layoff about 800 people if it loses state funding.

The layoffs also could have a domino effect, causing a decrease in income tax collection. People will have less disposable income. Thus, people will spend less, and sales tax revenues may decline, Dardenne said.

Dix said that gaming revenues are not the “magic” solution. The lottery is the only area where the Division of Administration boosted its projection by about $10 million.

Harrah’s in New Orleans, Louisiana’s only land-based casino, is continually paying it minimum obligation of $60 million to the state annually. Projections from riverboats, racetracks, and video poker were held stable by the division.

A final issue was raised about how to count the $87 million rent payment from Children’s Hospital in New Orleans. Barry Dusse from the State Budget Office explained that when the lease was signed, the hospital paid its rent in the fiscal year it was intended, or after July 1.

The Jindal administration required the hospital to pre-pay each rent in the prior fiscal year, or before June 30. Speaker Barras said he talked to a hospital representative, who said it was still comfortable with pre-paying rent this year.

“As a banker, if someone prepays me, I will gladly take it,” Barras said.